Tax Fraud Days of Action 2022: Kentucky

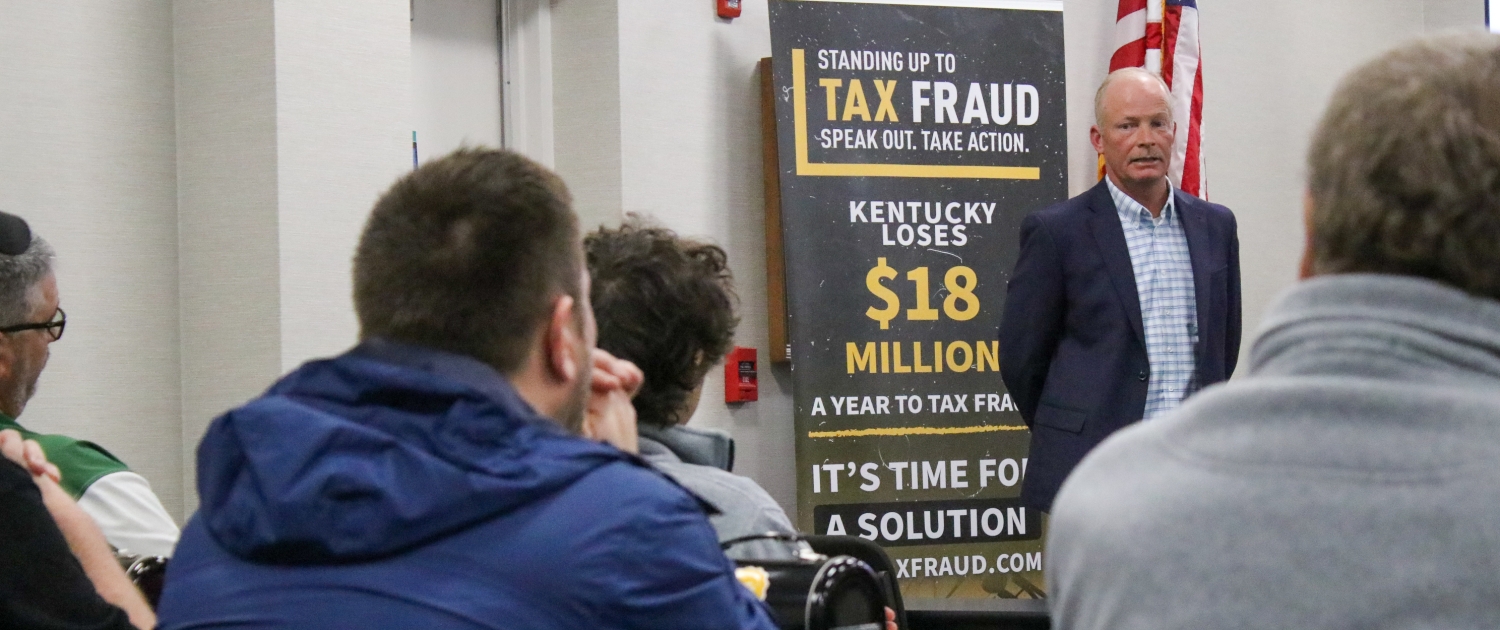

Indiana Kentucky Ohio Regional Council of Carpenters Representatives spoke with state and local officials on April 13th and 14th to learn more and speak out about construction industry tax fraud in Kentucky. Events were held by IKORCC across the three states and sponsored by the United Brotherhood of Carpenters across the United States and Canada.

More than 50 Senate and House Representatives stopped by our setup in the capitol building in Frankfort on April 13th. The statehouse was in session and full which opened the door for IKORCC to make new introductions with lawmakers who were unaware of construction industry tax fraud were made. All 200 meals and toolboxes were handed out.

On April 14th, over 25 officials including area mayors, State Representatives, judges, code enforcement officers, tax clerks, and local business owners attended a lunch and learn about tax fraud.

In Kentucky, it is last estimated that the state loses $18 million a year from misclassification. That money could equal:

- 348 teacher salaries, or

- 4,500 small business loans or

- 485 police officers

During the event in Grayson, local officials around the room spoke about their experience witnessing tax fraud in their communities.

“We weren’t even aware this was going on”, mayor of Grayson told to the room regarding construction tax fraud happening in his city before meeting with IKORCC.

Officials left both events with the tools to fight tax fraud in Kentucky including solutions like Responsible Bidder Ordinances, ways they can team up with the Department of Labor or the Department of Workforce Development, task forces, and strengthened language in current legislation.

This is a recap of the Indiana Kentucky Ohio Regional Council of Carpenters 2022 Tax Fraud Day of Action events. (2/3)